Overview

In our esteemed partnership with Argo, our consultancy took the helm of the sophisticated “One Finance” initiative. Our directive: facilitate a seamless consolidation of the finance operations of six recently acquired entities into a singular, cloud-based finance system.

Areas of Improvement

Process Engineering: In the wake of the acquisitions, it became paramount to integrate and streamline multiple finance systems into a singular, cloud-based platform, promoting operational uniformity and efficiency.

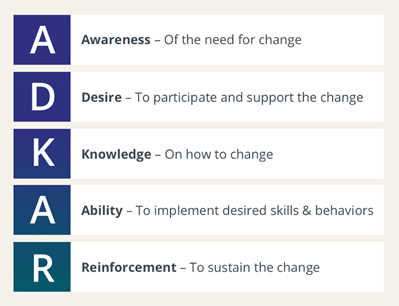

Change Management: To ensure the successful transition and adoption of this significant shift, a robust approach to navigating organizational change was crucial.

Portfolio/ Program/ Project Planning & Execution: Orchestrating such a vast initiative demanded precise planning and execution at various levels, ensuring every phase transitioned smoothly from blueprint to reality.

Challenge

The task of bringing six diverse financial units under a singular operational framework was laden with intricate challenges. Beyond technological aspects, the effort required aligning disparate work cultures, deeply ingrained methodologies, and varied operational practices into a synergized entity.

Solution

Employing a combination of Process Engineering for system and workflow optimization, Change Management for smooth organizational transition, and precise Portfolio/ Program/ Project Planning & Execution methodologies, we charted a strategic path for this endeavor. Every transition phase, from system migration to team integration, was implemented with exacting detail, ensuring business continuity and efficiency.

Outcome

Guided by our expert consultancy, the “One Finance” initiative achieved a paradigm shift for Argo. The once-separated entities now operate harmoniously as a consolidated finance hub, leveraging a unified system and streamlined best practices.