Overview

In a pivotal engagement with Erie Insurance, our consultancy was entrusted with the mission to enhance the Underwriting (UW) cycle time within their Commercial Lines segment. Given the complexities, a triage approach was adopted to holistically review overarching processes across three distinct portions of the Commercial Lines value stream. Our goal: to streamline, optimize, and elevate operational efficiency.

Areas of Strategic Focus

Holistic Process Review: Through detailed process mapping, our aim was to dissect and understand every facet of the Commercial Lines UW process, thereby identifying avenues for refinement.

Customer & Internal Feedback Analysis: Employing Voice of the Customer (VOC) methodologies and comprehensive survey development, we sought to capture both external client feedback and internal stakeholder insights.

Operational Efficiency Metrics: Utilizing tools like Value-Added (VA) and Non-Value-Added (NVA) analysis, Flow Analysis, and Benefit/Effort Analysis, our focus was on driving tangible improvements in efficiency and productivity.

Challenge

Erie Insurance’s Commercial Lines segment faced the pressing challenge of protracted UW cycle times. The task at hand wasn’t merely about incremental improvements, but a strategic overhaul of processes, ensuring that the UW cycle was both swift and efficient without compromising on the meticulousness that underwriting demands.

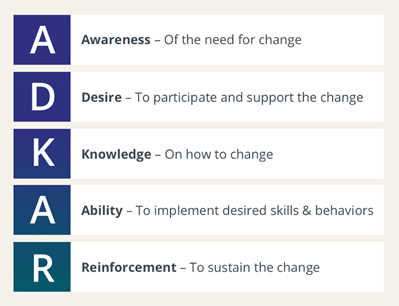

Strategic Approach

Our approach was comprehensive. From mapping intricate processes to conducting VO Cs and detailed surveys, we sought to gain a panoramic view of existing operations. Using tools like VA/NVA analysis, we were able to distinguish productive processes from potential bottlenecks, and with Flow Analysis and Benefit/Effort Analysis, chart a course for actionable improvements.

Impact & Outcome

Our collaboration with Erie Insurance unearthed multiple significant opportunities, each meriting exploration as individual projects. Projected outcomes from these initiatives are promising, spanning gains in quote ratios, reductions in both quoting time and cycle time, and a palpable rise in overall productivity.