Overview

In a strategic partnership with TXDOT, Kaeppel played a central role in the Modernization Program, an agency-wide initiative aimed at revamping and modernizing processes, tools, and technology. The core of our engagement was facilitating change management. We imparted training to over 400 agency executives, change leaders, and team members, and took the lead in the execution and oversight of 76 projects and programs.

Areas of Improvement

Organizational Modernization: The agency recognized a need to modernize its operations, processes, and technological tools to be more agile, efficient, and responsive to stakeholder needs.

Employee Training: Training was a key component, aiming to equip more than 400 agency executives and members with the skills and knowledge to navigate the transformation.

Change Management: Given the scale of the initiative, there was a clear demand for effective change management strategies to ensure a smooth transition.

Challenge

Modernizing an entire agency is no minor feat. Beyond the obvious technological shifts, it requires a profound understanding of organizational dynamics, people management, and strategy execution. Balancing the trifecta of people, process, and technology was the central challenge. Ensuring that the change was embraced and incorporated at all levels—from executives to team members—was essential for the program’s success.

Solution

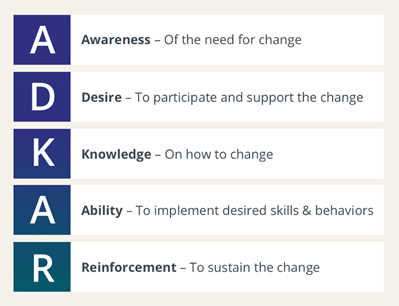

Utilizing a robust suite of tools including Project Management, Organizational Design, Performance Management, Workforce Planning, ADKAR Change Management, Portfolio Governance, Training Development, and Training Delivery, we orchestrated a change that would resonate agency-wide. Our approach ensured that each of the 76 projects and programs under the Modernization Program was executed with precision and aligned with the overarching agency vision.

Outcome

The results of our collaboration with TXDOT were transformative. The Modernization Program led to a complete agency metamorphosis. There was a marked increase in employee engagement, and the feedback from stakeholders reflected heightened satisfaction levels.